Credit is Debt is Slavery

by the late Bruce G. Mc Carthy

The reason I am posting this is because this 63 page booklet was one of a few that I studied in my younger years and revealed the true nature of what is ruining our country due to the advent of the Federal Reserve System. If you are a student of history and wish to gain more knowledge of the fundamental truths behind what is referred to as “money” this will be a welcome addition to your arsenal of knowledge. There is a link at the bottom that will allow you to download the complete 63 page booklet. If your interest is garnered in these first 10 pages you will want to obtain the full version. Written about 1980, this booklet is as timely then as it is now. So here we go…take the red pill and follow it down the rabbit hole to Wonderland… C.L.

This booklet is presented on behalf of the many Americans who want to be free … and the many more who think they are.

Many thanks to those dedicated individuals who have ceaselessly given of themselves to arouse an unsuspecting public as to the grave social and economic consequences we face, with special thanks to the Monetary Realists who have preserved the essence of the late Merrill Jenkins.

It is my sincere and fervent hope the reader will sense the magnitude of our plight and the urgency required to effect its resolution. May God grant you the wisdom to see and the strength to endure, for the time draws near when you must choose the path you will follow and let your ways be established.

In tendering the necessary Federal Reserve Notes to make this booklet possible, I hereby acknowledge the following:

1. Federal Reserve Notes are “liabilities” of the Federal Reserve Bank … a private corporation.

2. Federal Reserve Notes are non-redeemable … our monetary authority thereby acknowledging bankruptcy.

3. These FED Notes are evidence of “monetized debt,” being IOU/UOMe negotiable instruments.

4. Liabilities cannot pay off a debt … thereby leaving this transaction incomplete; the publisher having not been paid for this publication. I have merely transferred evidence of debt that cannot be paid.

5. I therefore disclaim all responsibility for my part in this monetary hoax, despite my awareness.

Money is a subject we all take a superficial interest in, but seldom do we seek an understanding of its nature or the consequences of leaving such matters to our “experts.” If we were to think diligently about such terms as “money, dollar, credit, bonds,” etc. we might just realize we have let familiarity breed contempt, just as many of us have come to take for granted such things as telephones, televisions, airplanes and the internal combustion engine. But how many of us fully understand how these things work, despite their everyday use? Keeping this in mind, let us examine more closely this thing called “money” and perhaps lay bare the reason for our distressed economy.

“All the perplexities, confusions and distresses in America arise not from defects in the Constitution or confederation, not from want of honor or virtue, as much as from downright ignorance of the nature of coin, credit and circulation!” ~John Adams

Webster’s Collegiate Dictionary defines money as:

1. Metal, as gold, silver or copper, coined or stamped, and issued as a medium of exchange. Also … Anything customarily used as a medium of exchange and measure ofvalue, as sheep, wampum, gold dust, etc.

6. Written or stamped promises or certificates, which pass current as a means of payment.

Funk & Wagnalls Standard Desk Dictionary adds a further definition of “money”:

4. Money of account.

Most people would agree that money means: a medium of exchange. But the same line of reasoning would have us call an airplane a medium of transportation. Likewise with a bus, train, bicycle, roller skates … even a pair of legs night be called a medium of transportation, but our definition is apparently vague. So “money” must be more concretely defined … unless of course there is no such tangible thing as money.

Aha! Suddenly we realize SOMETHING must be used AS money, and that “money” in and of itself does NOT exist. The Coinage Act of 1792 and the United States Statute Codes BOTH declare thus:

“The money of account of the United States shall be expressed in dollars …” 31 U.S.C. 371 and Coinage Act of April 2, 1792, Section 20.

“Dollars” are NOT the money … but the expression of the money. Similarly, concrete is expressed in cubic yards, but there are no foundations built out of cubic yards of cubic yards.

Concrete (the entity) is EXPRESSED in cu. yds. (unit of measure) and nobody would expect to pay a concrete company for cubic yards WITHOUT getting the concrete.

So what is the MONEY of account of the United States?

“No State shall … make any Thing but gold and silver Coin a Tender in Payment of Debts …” Article 1, Section 10 United States Constitution.

“… the proportional value of gold to silver in all coins which shall by law be current as money within the United States.” Coinage Act (1792), Section 11.

The terms ‘lawful money’ and ‘lawful money of the United States’ shall be construed to mean gold or silver coin of the United States: 12 U.S.C. 152

What then is a “dollar”? It is a UNIT OF MEASURE, with all of the substance of “an inch” or “a foot” or “a pound.” “Dollars” do not exist as a tangible thing. There are no inches of inches, feet of feet, pounds of pounds or dollars of dollars. A “dollar” is not a piece of paper, nor is it a coin. It is not a THING, only a unit of measure.

Likewise “money” is an abstract, an idea, not an entity. Something can be used AS money (e.g. silver, gold, corn, etc.) but there is no such thing (in and of itself) that is money.

Federal law declares gold and silver to be used AS money and to be EXPRESSED in “dollars,” with a “dollar” of gold being [1/42 troy oz.] fine gold (31 USC 449, 314, 821) and a “dollar” quantity of silver 371.25 grains pure (Coinage Act 1792).

Since the term “dollar” was a unit of measure expressing still another unit of measure (troy oz. and grain), most Americans came to regard the “dollar” as the THING for which it was only the unit of measure. Mysterious forces “crept in unawares” managed to remove the “thing” and substitute the unit of measure (no-“thing”) thereby destroying our economic foundation. We are pouring foundations measured in “cubic yards” … but somebody stole the concrete!

Over the years we have been “blessed” with a variety of “dollars”; one of gold (the smallest coin minted in the U.S.), one of 90% silver, one of 40% silver (some Eisenhower “$”s), one of standard dimension with NO silver (Eisenhower), the NO NOTHING “super quarter” called the Susan B. “Agony” and the real cheapskate “PAPER dollar.” As the “dollar” was fashioned from cheaper materials, the “prices” mysteriously began to rise … some calling the phenomena … inflation.

A more realistic way of looking at this might be to say that the “money of account” (gold and silver) was progressively removed from circulation, being substituted by cheaper substances, yet retaining the asserted value by fiat or declaration. Since the public still THOUGHT the “money” was the same, the “money of account” became an IMAGINARY nonentity as a result of progressively greater seigniorage (difference between face value and free market value). Our “money of account” is now 100% seigniorage as we will see more closely later in this text. At any rate, the 90% silver coins have been debased to tokens of copper/nickel with no silver. Shouldn’t products cost more in copper/nickel “dollars” than in silver “dollars”?

“Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency.” John Maynard Keynes — Economist

Throughout history, man has used many different things as money (e.g. cows, salt, cowry shells, tea, opium, tobacco, rice, stone wheels, iron, gold, etc.) but despite their dissimilarity, they all possessed a unifying characteristic; they were all wealth. And wealth is TANGIBLE.

Now if “dollars” measure silver and gold, and States are required to settle debts in these precious metals … WHERE IS the silver and gold? It was stolen by some very clever folks in a most subtle manner, but we'll cover that later. First we must understand some very basic economics.

Trade (commerce) has been the motivating force behind the establishment of “money,” and as the volume of trade increased, there was a change in the substance that was used as money, especially as man developed the talents of processing ores and fashioning coins. Let's consider a simple illustration to demonstrate the need for an exchange medium. Joe would like to buy 2 goats from Bill and is willing to “pay” 1 sheep. But Bill doesn’t want any sheep but would like to have a cow. Dilemma! Joe has no cows … but! Harry has oodles of ‘em. New Deal (not to be confused with FDR)! Joe is able to trade 2 sheep for 1 cow. New dilemma! If 1 cow = 2 sheep and 1 sheep 2 goats, 1 cow must = 4 goats. Therefore: 2 goats (what Joe wanted in the first place) must be ½ cow. But without a freezer Bill will have little use of ½ cow. Idea! Joe offers Bill an intermediate substance called salt, and Bill accepts since he recognizes the “swap-ability” of salt. Bill could then offer this salt (plus a little more) to Harry in exchange for a cow. Salt was used as money since it was the medium of exchange.

Salt money gave way (thank heavens!) to silver and gold which have been acceptable worldwide as money for over 3,000 years. Gold and silver (wealth) were slowly replaced by “money” (imaginary demand) in such a way the public was either unaware or even an accessory to the fraud. In ancient times, a goldsmith (forerunner of the modern banker) would store peoples' gold for safekeeping (and a fee). He soon discovered that few people reclaimed their gold (relative to his stock) since it represented surplus (savings), and being shrewd (euphemism for crooked) the goldsmith began to “lend” out a considerable portion of the gold for a fee or “interest,” keeping just enough (sometimes) to cover his hind end (depositors). Banking (lending) soon replaced saving (banking). Something else was discovered. The receipts (issued by the goldsmith to the depositors) soon began to circulate as “currency” since they provided “convenience” but could still claim the gold through redemption, provided the crook in the middle still had some in his vault. Similarly, in the U.S., proxy certificates began to circulate in lieu of the gold and silver coin, but they could always (so we thought) claim the precious metal they represented … that is until somebody decided to close the gold “window” in 1933 and the silver “window” in 1968.

At one time, bankers were merely middlemen. They made a profit by accepting gold and coins brought to them for safekeeping and lending them to borrowers. But they soon found that the receipts they issued to depositors were being used as a means of payment. These receipts were acceptable as money since whoever held them could go to the banker and exchange them for metallic money.

Then bankers discovered that they could make loans merely by giving borrowers their PROMISES TO PAY (bank notes). In this way, banks began to CREATE money. More notes, could be issued than the gold and coin on hand because only a portion of the notes outstanding would be presented for payment at any one time.

Demand deposits are the modern counterpart of bank notes. It was a small step from printing notes to making BOOK ENTRIES to the credit of borrowers which the borrowers, in turn, could ‘spend’ by writing checks. ~Modern Money Mechanics, pub. by Federal Reserve Bank of Chicago, p 3,4 (emph. mine)

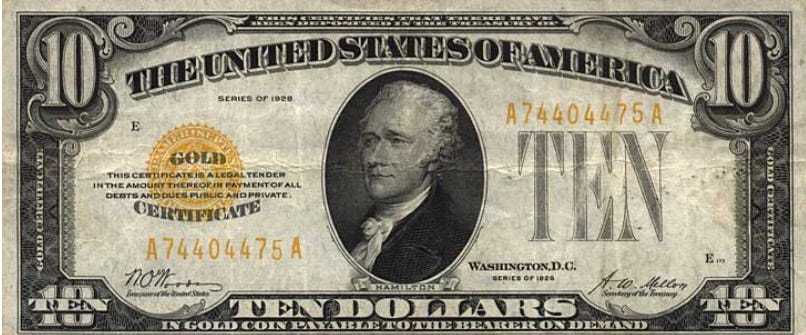

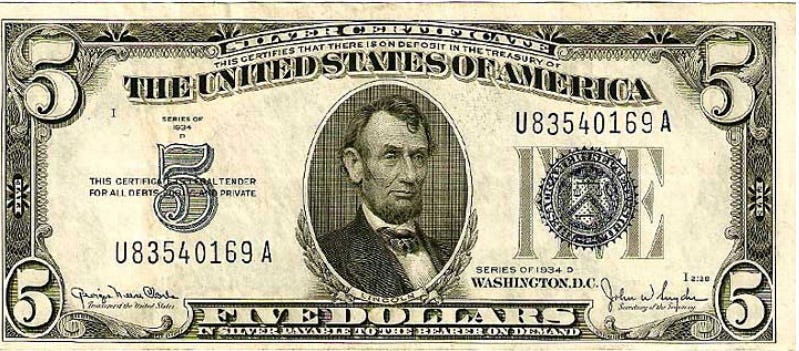

And until 1963, all paper currency in circulation NEVER claimed to be the “money,” nor did it claim to be DOLLARS. The paper was REDEEMABLE in SILVER or GOLD EXPRESSED IN DOLLARS. The following examples will illustrate this point.

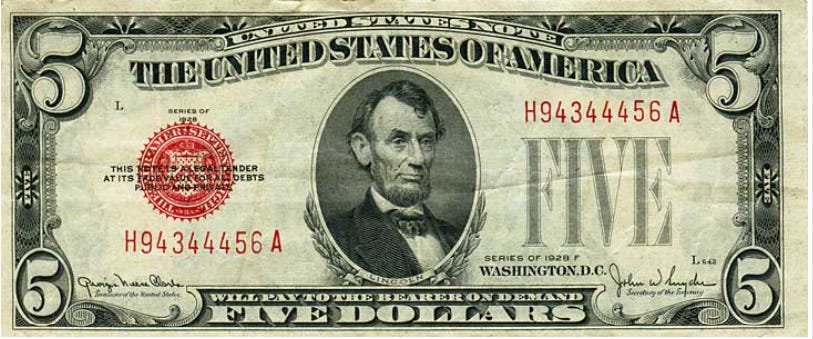

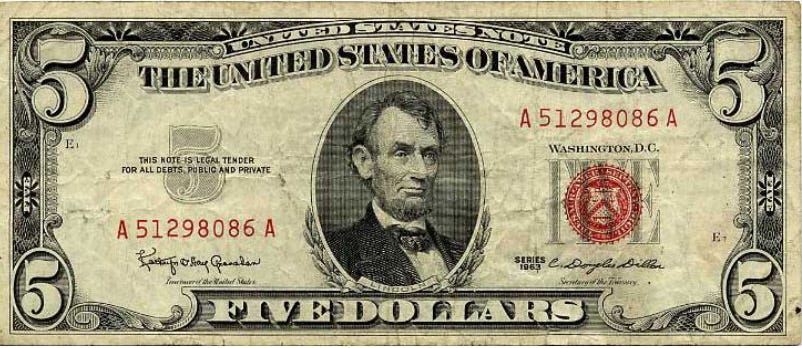

Below, are four specimens of paper currency, the top three of which are lawful negotiable instruments (or notes) in that they identify WHO is paying, WHAT is being paid, to WHOM, and WHEN (see Black’s Law Dictionary). The bottom note does NOT conform to the lawful definition of a note!

Federal Reserve Notes are not federal, represent no monetary reserves and no longer conform to the definition of notes. Failing to state who, will pay what, when or to whom - they ceased to be legal tender notes, (offers of money) almost 60 years ago. They are in fact instruments of legalized THEFT. C.L.

Looking for a moment at the bottom two notes, we will reason this out. If the upper (of the two) note claimed “The United States of America … will pay to the bearer on demand … FIVE TOMATOES,” it would still be a lawful note (even a lawful contract). If, however, the words “will pay to the bearer on demand” are removed (as in the bottom specimen), would that convert the piece of paper into FIVE TOMATOES?!

Paper currency issued & printed by The Treasury of the U.S. Government

Gold certificate (was redeemable for gold coin). Notice! These certificates did not claim to BE dollars, but would PAY in dollars (of gold)

Silver certificate (was redeemable for silver). Again, these were NOT the dollars but were redeemable FOR (in this case) a 5 dollar QUANTITY of SILVER

A U.S. NOTE (a liability, or evidence of a debt, to the bearer or holder). If this note will PAY the bearer, on demand, 5 DOLLARS, can this piece of paper possibly BE 5 dollars?

U.S. Note (acknowledgment of debt), that claims to BE a quantity of the entity to SETTLE THE DEBT. Impossible!

Paper Currency Issued by the Federal Reserve Banks (Private Corporations) but still printed by the U.S. Government

If I have managed to gain your interest in this subject and you would like the "rest of the story",.. Click on the link below and download the complete 63 page booklet written by the late Bruce G. McCarthy This booklet was one of the main teaching aids that I have had at my disposal and has been one of the most influential booklets that have led me down the path to REALLY understand the workings of the banking system...

Complete Booklet Credit is Debt is Slavery. Get you copy NOW! C.L.

Many, if not most, of the world's ills can be laid at the feet of central bankers and their minions, been that way for centuries, now, and most people don't have a clue.

Superior serendipity, this. Just today I was listening to comments on Davos, and the push to adopt CBDC's as another form of money. In addition to the new digital fiat would be a redefinition of money.

From Docket number 1670 on the Federal Reserve website. The "benefits of moving to a CBDC." (this from the video below)

"The main attributes of a technically effective currency:

A unit of account is a common measure for the value of goods and services, the store of value is the way we store wealth in order to transfer purchasing power from the present to the future, and the medium of exchange function dictates which item is accepted for the payment of goods and services. In recent history, these functions have been fulfilled by fiat currencies backed by central banks across developed and developing nations. Through monetary policy manipulation, the key attraction of these currencies - price stability and widespread acceptance - is implemented through a central banking system, enjoying a great deal of trust globally. "

"But there is a fourth function of money: Social Control"

https://www.youtube.com/watch?v=2GMtNGarL80

Your servitude will be even further ensured by your ACCESS to money. No longer will a pocket of credit notes provide the scant freedoms now enjoyed as those notes will be in your digital wallet only as long as your keepers are satisfied with your behavior and performance. 666 much?